Charging Infrastructure Requirements

There is not enough electricity on the grid today, and scaling electricity demand and distribution under EPA and CARB’s timelines will be challenging. Full electrification of the entire U.S. vehicle fleet will require a 40.3% increase in the nation’s current electricity generation and 14% for freight trucks alone.

- After one prominent trucking company recently tried to electrify a mere 30 trucks at a terminal in Illinois, local officials shut that plan down, saying it would draw more electricity than is needed to power the entire city.

- Today, fleets must interact with a complex web of over 3,200 locally owned electric utilities to install charging infrastructure on-site required to comply with new regulations. Utilities often estimate lead times of 18 months to three years before installation is completed.

- Refueling hydrogen infrastructure for commercial trucks is nonexistent today.

The charging infrastructure is nowhere near ready. Using today’s truck & charging requirements, more chargers and new hydrogen refueling stations will be needed than parking spaces, even though there is already a severe, chronic nationwide shortage of commercial truck parking.

- According to a Ricardo analysis, to scale the deployment of medium- and heavy-duty battery-electric trucks envisioned by EPA’s GHG3 rulemaking, 15,625 chargers must be installed monthly between now and 2032.

Electricity Needs are Already Significant

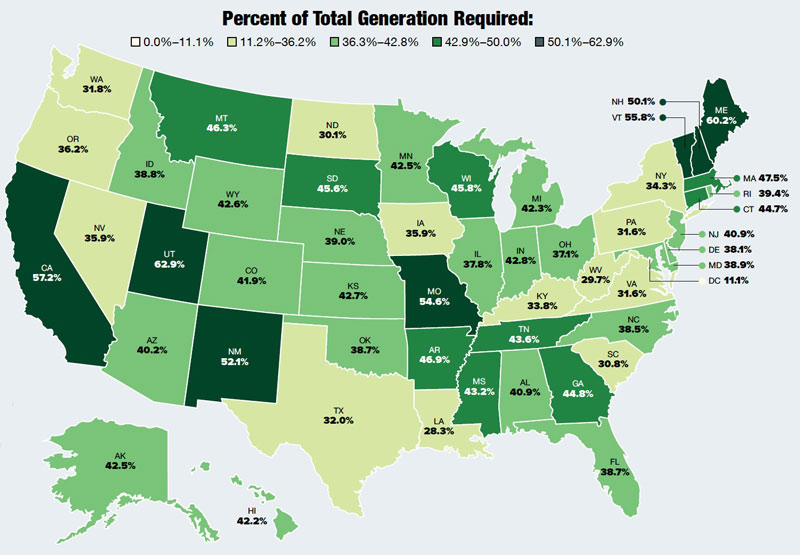

Full electrification of the U.S. vehicle fleet would require a large percentage of the country’s existing electricity generation, including:

- 26.3% for passenger cars and trucks

- 14% for all freight trucks, including 10.6 percent for long-haul trucks

- 40.3% for all vehicles

Some states would need more than 50 percent of current electricity generation to meet vehicle travel needs (see map at right).

Large-scale infrastructure investment would be a necessary precursor to electrification.

Data and charts courtesy of the American Transportation Research Institute.

Truck Charging and the Truck Parking Crisis

Truck Charging Availability will be the Truck Parking Crisis 2.0

Using today’s truck and charging requirements, more chargers will be needed than parking spaces.

Regardless of advances in battery capacity or charge rates, BEV charging will be limited by federal Hours-of-Service rules for drivers and parking availability.

Initial equipment and installation costs at the nation’s truck parking locations will top $35 billion, based on average per-unit purchase and installation costs of $112,000.

Additionally, to understand the truck parking challenges, ATRI quantified the truck charging needs at a single rural rest area, which would require enough daily electricity to power more than 5,000 U.S. households.

Other barriers include laws preventing commercial charging at public rest areas and the remoteness of many truck parking locations.

There currently is no U.S. network where over-the-road trucks can stop for rest breaks and recharge simultaneously.